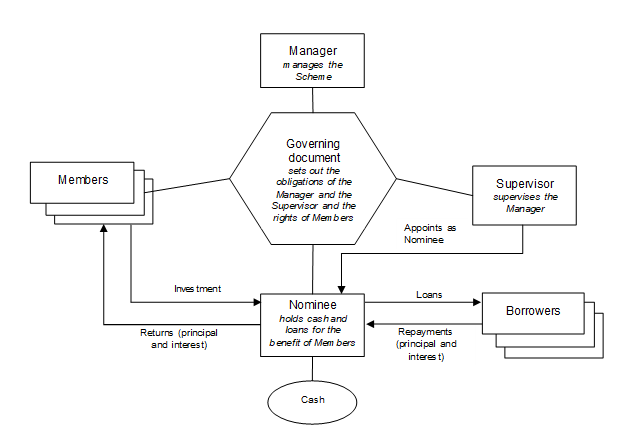

Our aim is to make available loan investments at attractive rates to Members and to provide funding by way of secured registered first or second mortgage to borrowers who may not fit normal bank criteria.

A simple process

- Obsidian Group Limited obtain a registered valuation confirming that the loan-to-value ratio (LVR) is either 66% on a loan secured by a first mortgage or 80% (being typically 66% on first mortgage plus an additional 14% on second mortgage) on a loan secured by a second mortgage.

- The borrower meets all requirements. Please see our borrowing section for details.

- The Scheme's investment strategy, as set out in its SIPO, is checked against the proposed investment. Please see our investing section for details.

Things to know:

Please make sure you understand the risks.

Interest rate payable is set on a loan at the time of establishment and is either fixed or variable.

The interest rate is typically agreed with the Borrower on the basis of market interest rates for similar loans.

To mitigate against interest rate risks, if the interest rate is not fixed, Obsidian Group Limited may vary rate during the term of the investment. This is to ensure the loan fund advanced meet current lending criteria and provide sufficient returns to Members.

Returns are currently made to Members by way of quarterly interest payments from Borrowers.

The majority of loans are advanced on an interest only basis without principal being repaid unless by prior agreement.

Obsidian Group Limited does not provide investment or financial advice to Members or the general public.

WARNING

The law normally requires people who offer financial products to give certain specified information to investors before they invest. This requires those offering financial products to have disclosed information that is important for investors to make an informed decision.

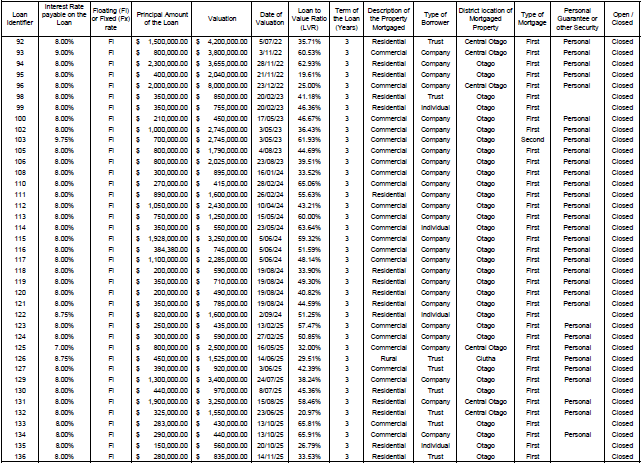

The usual disclosure rules do not apply to this offer because there is an exemption for offers of investments in the Scheme. Information about each loan will be set out in a Loan Specific Disclosure Statement (Loan Disclosure) provided to you by the Manager. As a result of the exemption, you will need to read both the Loan Disclosure and the Product Disclosure Statement (PDS) to understand the overall risks and fees that will apply to your loan portfolio. You should also refer to the table provided to you along with the PDS to see the types of loans that have been made by the Scheme recently.

You will also not be able to easily compare an investment in the Scheme with other managed investment schemes.

Additionally, the exemption allows the Manager to only prepare audited financial statements at the Scheme level, and not to have to also prepare individual audited financial statements for each separate loan. The Scheme financial statements include information about all loans in the Scheme collectively, but with some consideration of individual loans (as required by the conditions to the exemption). Not all information in the financial statements will be relevant to your individual portfolio and there will be limited information about individual loans. As a result, you will need to read the financial statements in conjuction with your relevant loan disclosure documents and personalised quarterly reports to understand the overall position in relation to your individual portfolio.

Investment in the Scheme will not be suitable for all retail investors. We suggest you ask questions and read all documents carefully.

Loans offered by the Scheme for the Quarter ending 31 December 2025